Business Insurance in and around Indianapolis

Indianapolis! Look no further for small business insurance.

No funny business here

Your Search For Great Small Business Insurance Ends Now.

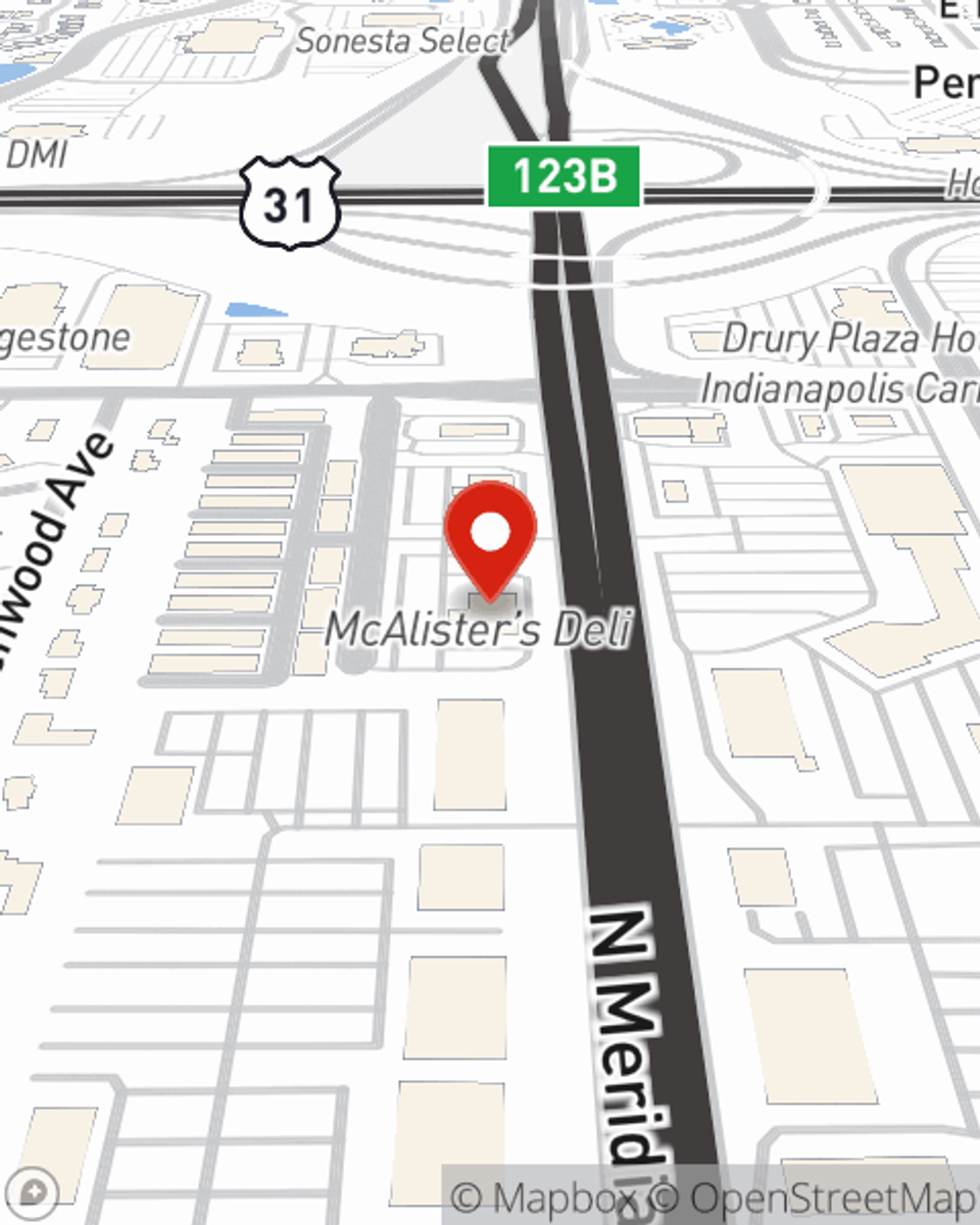

It's a lot of responsibility to start and run a business, but you don't have to figure it out all by yourself. As someone who also runs a business, State Farm agent David Gilmore understands the work that it takes and would love to help lift some of the burden. This is coverage you'll definitely want to investigate.

Indianapolis! Look no further for small business insurance.

No funny business here

Cover Your Business Assets

If you're looking for a business policy that can help cover accounts receivable, business property, and more, State Farm may be able to help, just like they've done for other small businesses for almost 100 years.

When you get a policy through one of the leading providers of small business insurance, your small business will thank you. Contact State Farm agent David Gilmore's team today to discover your options.

Simple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

David Gilmore

State Farm® Insurance AgentSimple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.